Veronex is

Solana’s Speed

Ethereum’s Security

Unmatched

Flexibility

Ethereum’s First SVM L2

prioritize scale and UX

Solana’s

Speed

Prioritizing Scale and User Experience

VERONEX leverages the speed and efficiency of Solana’s virtual machine to deliver a seamless, high-performance experience. With ultra- fast finality and support for thousands of transactions per second, it powers real-world applications without compromising on decentralization.

Solana-Grade Speed. Ethereum-Grade Security. VERONEX-Level UX.

Build Where the Value Lives

Access Ethereum’s Liquidity

VERONEX connects directly to Ethereum’s deep liquidity and established user base. With over $80B in stablecoins, $66B in TVL, and ETH as a $450B reserve asset, developers and projects can tap into the most trusted ecosystem in crypto – without sacrificing speed or flexibility.

Build. Deploy. Scale.All on VERONEX.

Defi

$500B+

In assets secured on Ethereum

$0.0002

Average transaction cost with VERONEX

Gaming

Onchain Frameworks

Launch game logic on-chain in days

Next-Gen 2D Engines

Optimized for visual quality and time to market

Consumer

500K+

Active Ethereum addresses

Native Identity Layer

Fully compatible across EVM ecosystems

Backed and

FUNDED BY VISIONARY INVESTORS AND BULDERS

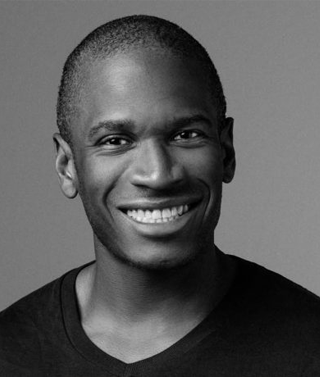

Jonny Lee

(Investor)

“If you’re early, you don’t need to be perfect — just present. I see Veronex easily doing a 100x in the next cycle.”

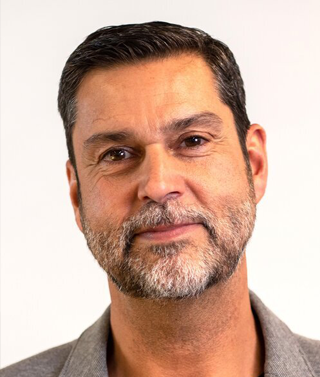

Changpeng Zhao

(CZ, Founder Binance)

“Innovation attracts liquidity. If Veronex proves its tech stack, listings and price movement will follow naturally.”

Pavel Durov

(CEO Telegram)

“Layer 1s with real utility and community always win. Veronex reminds me of early Toncoin — and we know what happened there.”

Vitalik Buterin

(Co-Founder Etherium)

“Modular architecture with zk integration is the future. If Veronex gets this right, it could outperform Ethereum’s early trajectory.” (ETH went from $0.30 to $4,800 — over 1,600x.)

Gavin Wood

(Polkadot / Ethereum Co-Founder)

"Developer-first chains will dominate the next phase. Veronex is designed for scale, and could reach top 50 status within one year."

Hayden Adams

(Founder Uniswap)

"Developer-first chains will dominate the next phase. Veronex is designed for scale, and could reach top 50 status within one year."

Anatoly Yakovenko

(CEO Solana)

“Layer 1s with real utility and community always win. Veronex reminds me of early Toncoin — and we know what happened there.”

Charles Hoskinson

(Cardano Founder)

"Interoperability isn’t optional anymore. Veronex integrates it natively — which puts a 300x upside on the table."

Stani Kulechov

(Founder Aave)

"True modularity and cross-chain logic — Veronex could become the go-to Layer 1 for next-gen DeFi. That’s a 200x narrative."

Emilie Choi

(COO Coinbase)

“Governance, modular tech, dev activity — Veronex ticks all the boxes for future exchange consideration.”

Arthur Hayes

(Co-Founder BitMEX)

“I like asymmetry. Buying Veronex under 5 cents? That’s a rare upside. Mid-term this could be worth $100–150 or more.”

Raoul Pal

(Macro Investor)

“Exponential assets define the next decade. Veronex sits exactly where Ethereum did in 2016. 500x? Not crazy.”

Brian Armstrong

(CEO Coinbase)

“We’re watching infrastructure plays. Veronex has a serious shot if they maintain this dev velocity.”

Sandeep Nailwal

(Polygon CEO)

“Scaling is more than speed — it’s UX, dev support, and modularity. Veronex is building all three into its core.”

Peter Thiel

(Investor, PayPal Founder)

“Founders who build hard tech win big. If Veronex captures even a small slice of the Layer 1 future, massive gains are possible.”

Paradigm

One of the largest and most influential crypto funds. Major investments include Coinbase, Uniswap, Synthetix, and Friend.tech. Known for deep thesis-driven support. Paradigm Capital zk-native, modular, interoperable — Veronex fits the exact profile we look for in high-conviction early-stage bets

Polychain Capital

Originally focused on Ethereum, now active across Layer 1s, privacy tech, and staking ecosystems. Founded by Olaf Carlson-Wee, the first employee at Coinbase. Polychain Capital "Veronex feels like Solana back in 2020 — fresh, undervalued, technically ambitious. Definitely on our radar."

Pantera Capital

One of the oldest crypto-focused investment firms. Backed Bitcoin, Ethereum, Zcash, Near, and many infrastructure projects. Pantera Capital “Smart architecture at the infrastructure level = generational wealth. Veronex has the right timing and narrative for a 300x run.”

Multicoin Capital

An aggressive, thesis-driven fund. Early backers of Solana, Helium, and The Graph. Strong focus on scalability and data layers. Multicoin Capital “We watched Solana go from cents to $200+. Veronex could mirror that trajectory if it builds a strong dev and validator base.”

Delphi Digital

Known for their in-depth research and advisory. Invest heavily in Web3 gaming, L2 ecosystems, Metaverse projects, and AI-driven protocols. Delphi Digital “AI, DePIN, zk, modularity — Veronex combines all the major narratives. That’s why it could explode once it hits mainnet.”

Pavel Durov

(CEO Telegram)

“Layer 1s with real utility and community always win. Veronex reminds me of early Toncoin — and we know what happened there.”

Vitalik Buterin

(Co-Founder Etherium)

“Modular architecture with zk integration is the future. If Veronex gets this right, it could outperform Ethereum’s early trajectory.” (ETH went from $0.30 to $4,800 — over 1,600x.)

Jonny Lee

(Investor)

“If you’re early, you don’t need to be perfect — just present. I see Veronex easily doing a 100x in the next cycle.”

Changpeng Zhao

(CZ, Founder Binance)

“Innovation attracts liquidity. If Veronex proves its tech stack, listings and price movement will follow naturally.”

Anatoly Yakovenko

(CEO Solana)

“Layer 1s with real utility and community always win. Veronex reminds me of early Toncoin — and we know what happened there.”

Charles Hoskinson

(Cardano Founder)

"Interoperability isn’t optional anymore. Veronex integrates it natively — which puts a 300x upside on the table."

Gavin Wood

(Polkadot / Ethereum Co-Founder)

"Developer-first chains will dominate the next phase. Veronex is designed for scale, and could reach top 50 status within one year."

Hayden Adams

(Founder Uniswap)

"Developer-first chains will dominate the next phase. Veronex is designed for scale, and could reach top 50 status within one year."

Arthur Hayes

(Co-Founder BitMEX)

“I like asymmetry. Buying Veronex under 5 cents? That’s a rare upside. Mid-term this could be worth $100–150 or more.”

Raoul Pal

(Macro Investor)

“Exponential assets define the next decade. Veronex sits exactly where Ethereum did in 2016. 500x? Not crazy.”

Stani Kulechov

(Founder Aave)

"True modularity and cross-chain logic — Veronex could become the go-to Layer 1 for next-gen DeFi. That’s a 200x narrative."

Emilie Choi

(COO Coinbase)

“Governance, modular tech, dev activity — Veronex ticks all the boxes for future exchange consideration.”

Peter Thiel

(Investor, PayPal Founder)

“Founders who build hard tech win big. If Veronex captures even a small slice of the Layer 1 future, massive gains are possible.”

Paradigm

Paradigm Capital

One of the largest and most influential crypto funds. Major investments include Coinbase, Uniswap, Synthetix, and Friend.tech. Known for deep thesis-driven support.

Brian Armstrong

(CEO Coinbase)

“We’re watching infrastructure plays. Veronex has a serious shot if they maintain this dev velocity.”

Sandeep Nailwal

(Polygon CEO)

“Scaling is more than speed — it’s UX, dev support, and modularity. Veronex is building all three into its core.”

Multicoin Capital

An aggressive, thesis-driven fund. Early backers of Solana, Helium, and The Graph. Strong focus on scalability and data layers. Multicoin Capital “We watched Solana go from cents to $200+. Veronex could mirror that trajectory if it builds a strong dev and validator base.”

Delphi Digital

Known for their in-depth research and advisory. Invest heavily in Web3 gaming, L2 ecosystems, Metaverse projects, and AI-driven protocols. Delphi Digital “AI, DePIN, zk, modularity — Veronex combines all the major narratives. That’s why it could explode once it hits mainnet.”

Polychain Capital

Originally focused on Ethereum, now active across Layer 1s, privacy tech, and staking ecosystems. Founded by Olaf Carlson-Wee, the first employee at Coinbase. Polychain Capital "Veronex feels like Solana back in 2020 — fresh, undervalued, technically ambitious. Definitely on our radar."